If you encounter any technical difficulties with accessing the virtual Meeting, please call the technical support number that will be posted on the Meeting website log-in page.

How

cando I

vote my shares without attending the Meeting?vote?

Whether you hold shares directly as the stockholder of record or beneficially in street name, you may direct your vote without attending the Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker, bank or nominee.

Please refer to the summary instructions below and those included on your proxy card

and in the Notice or, for shares held in street name, the voting instruction card included by your broker, bank or nominee.

Stockholder of Record

If you are a stockholder of record, the Notice instructs you as to how (i) you may access and review all of the proxy materials on the Internet, (ii) you may submit your proxy, and (iii) to receive paper copies of the proxy materials if you wish. No printed materials will be available unless you specifically request them by following the instructions in the “Notice Regarding the Availability of Proxy Materials.”

VOTE BY MAIL—You may vote by mail by marking, signing and dating your proxy card

or, for shares held in street name, the voting instruction card included by your broker, bank or nominee and mailing it in the

accompanying enclosed, pre-addressed envelope.

If the pre‑addressed envelope is missing, please mail your completed proxy card to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. If you provide specific voting instructions, your shares will be voted as you

instruct. If the pre-addressed envelope is missing, please mail your completed proxy card to American Stock Transfer & Trust Company, LLC at 6201 15th Avenue, Brooklyn, NY 11219, Attn: Operation Center. BY INTERNET OR TELEPHONE—If you hold shares through a broker or other nominee in "street name," you may be able to vote by the Internet or telephone as permitted by your broker or nominee. The availability of Internet and telephone voting for beneficial owners will depend on the voting process of your broker, bank or other holder of record. Therefore, we recommend that you follow the voting instructions you receive.

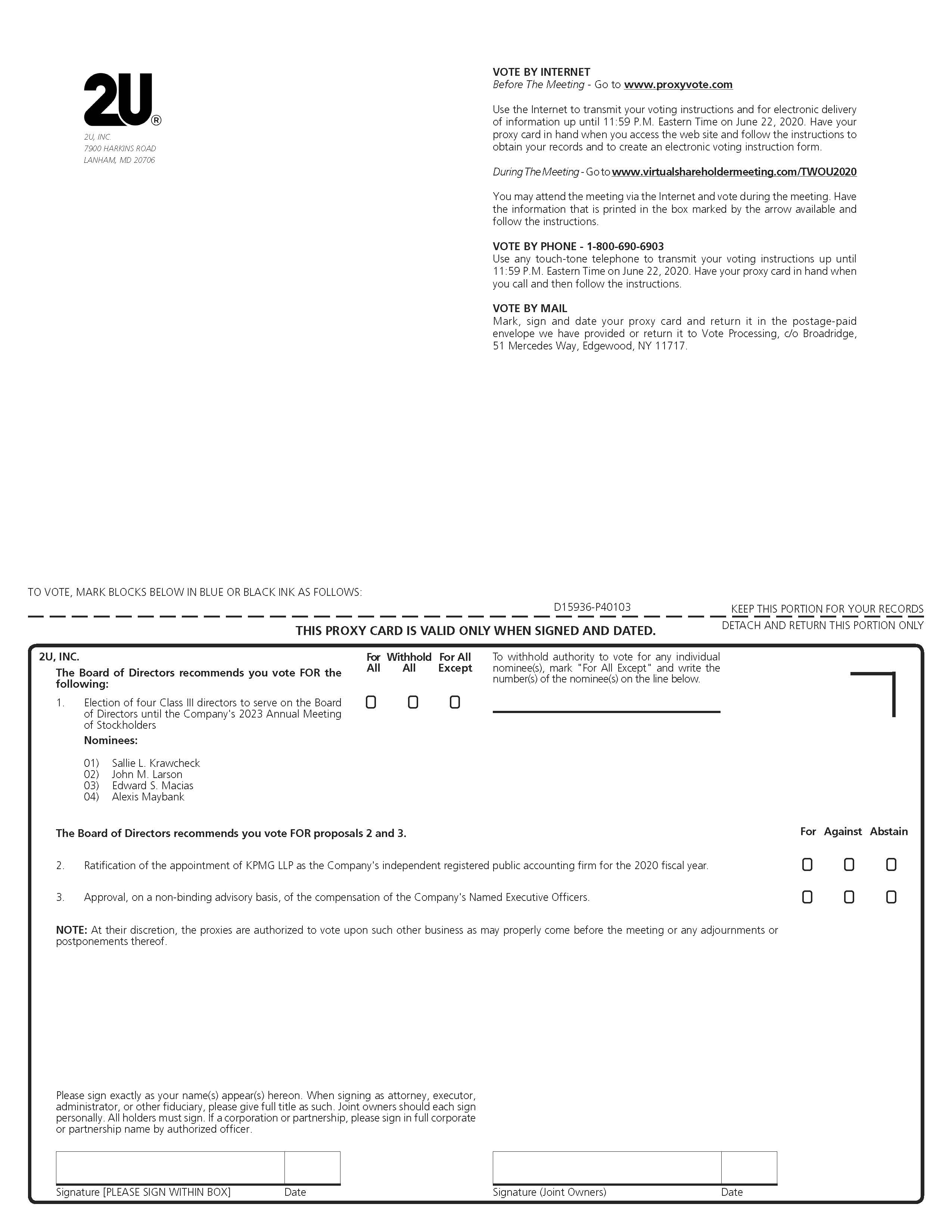

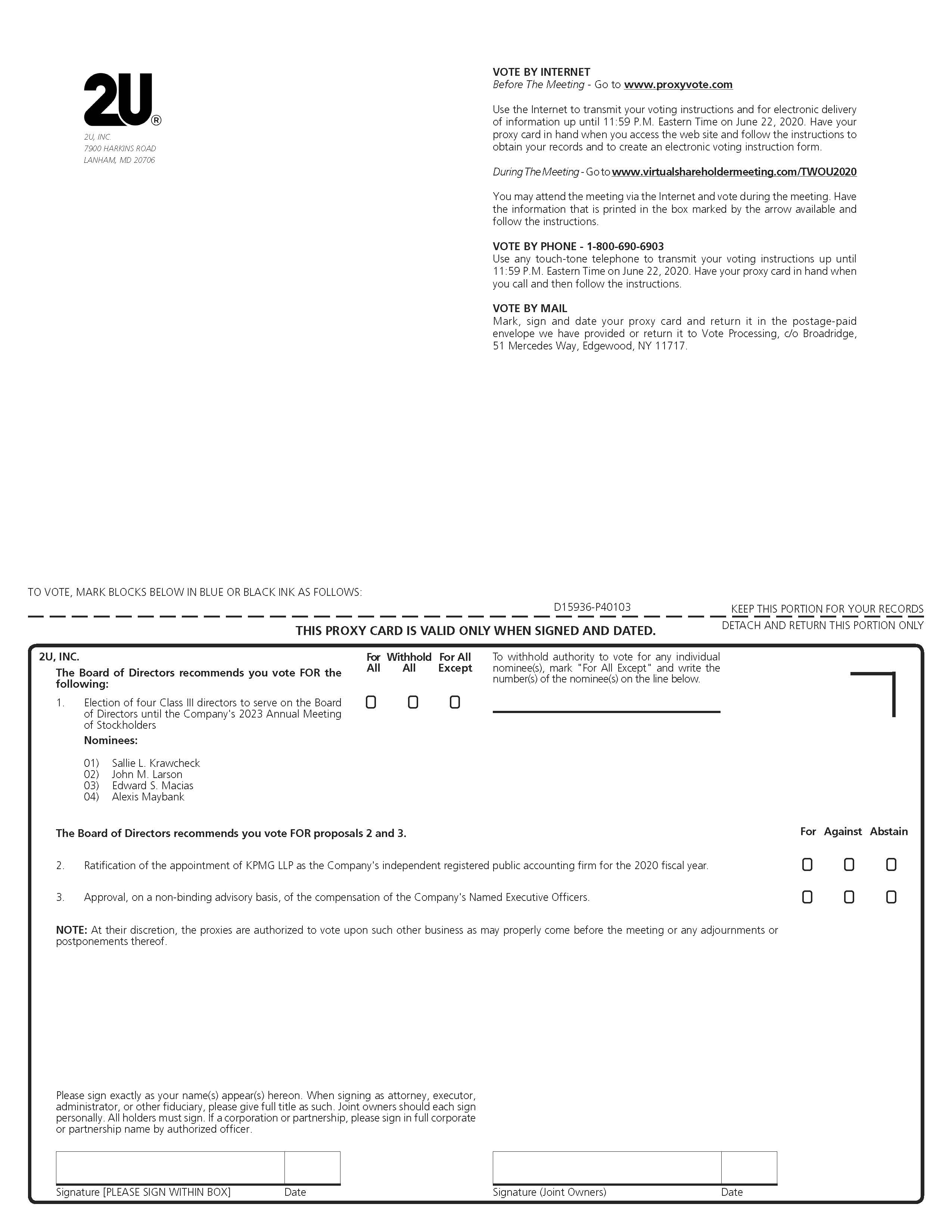

If you cast your vote in any of the ways set forth above, your shares will be voted in accordance with your voting instructions,instruct, unless you validly revoke your proxy. Broadridge must receive your proxy card no later than June 22, 2020, the day before the Meeting, for your proxy and your vote to be counted. If you are a stockholder of record and you sign and return your proxy card but you do not specify how you want to vote your shares, we will vote them "FOR"“FOR” the election of each of the four Class III directors listed in Proposal One, “FOR” Proposal Two and “FOR” Proposal Three and for "ONE YEAR" for the Company's frequency of non-binding "say on pay" advisory vote.Three. We do not currently anticipate that any other matters will be presented for action at the Meeting. If any other matters are properly presented for action, the persons named on your proxy will vote your shares on these other matters in their discretion, under the discretionary authority you have granted to them in your proxy.

VOTE BY INTERNET—To vote via the Internet before the Meeting, log on to: www.proxyvote.com and follow the instructions on the Notice or proxy card. We permit Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. You must submit your Internet proxy before 11:59 p.m. Eastern time on June 22, 2020, the day before the Meeting, for your proxy and your vote to be counted. Please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies. You may also vote during the Meeting at: www.virtualshareholdermeeting.com/TWOU2020 by using the 16-digit control number on your Notice or proxy card.

VOTE BY TELEPHONE – To vote via telephone call the toll-free number on your Notice or proxy card. Telephone voting is available 24 hours per day until 11:59 p.m. Eastern time on June 22, 2020, the day before the meeting.

Beneficial Owner

If you hold shares through a broker, bank or nominee in street name, you will need to follow the voting instructions provided by your broker, bank or nominee. Many brokers, banks or nominees offer the option to vote by the Internet or telephone. The availability of Internet and telephone voting for beneficial owners will depend on the voting process of your broker, bank or other holder of record. Therefore, we recommend that you follow the voting instructions you receive.

If you own shares in "street name"street name through a broker, bank or nominee and you do not provide instructions to your broker, bank or nominee on how to vote your shares, your broker, bank or nominee has discretion to vote these shares on certain "routine"“routine” matters, including the ratification of the appointment of KPMG LLP as our independent registered public accounting firm. However, on non-routinenon‑routine matters, such as the election of directors and the approval, on a non‑binding advisory basis, of the compensation of the Company’s Named Executive Officers, your broker must receive voting instructions from you because it does not have discretionary voting power for these proposals. So long as the broker has discretion to vote on at least one proposal, these "broker non-votes" are counted toward establishing a quorum. When voted on "routine" matters, broker non-votes are counted toward determining the outcome of that "routine" matter.Therefore, it is important that you provide voting instructions to your broker, bank or other nominee. So long as the broker has discretion to vote on at least one proposal, these “broker non‑votes” are counted toward establishing a quorum.

Can I change my vote after I submit my

proxy?proxy or voting instructions?

Yes. If you hold shares directly as the stockholder of record, even after you have submitted your proxy, you may change your vote at any time prior to the close of voting at the Meeting by:

filing with our Corporate Secretary at 8201 Corporate Drive, Suite 900, Landover,7900 Harkins Road, Lanham, Maryland 2078520706 a signed, original written notice of revocation dated later than the proxy you submitted,

•submitted;submitting a duly executed proxy card bearing a later date,date; or

Table of Contents

•attendingvoting again via the Meeting and voting in person.

In order to revoke your proxy, prior toInternet, including during the Meeting, we must receive an original notice of revocation of your proxy at the address above sent by U.S. mail or overnight courier. Meeting.

If you grant a proxy, you are not prevented from attending the Meeting

(virtually) and voting

in person.via Internet at the Meeting. However, your attendance at the Meeting will not by itself revoke a proxy that you have previously granted; you must vote

in personvia Internet at the Meeting to revoke your proxy.

If your shares are held in a stock brokerage account or by a bank or other nominee, you may revoke your

proxyvoting instructions by following the instructions provided by your broker, bank or nominee.

All shares that have been properly voted and not revoked will be voted at the Meeting.

Is there a list of stockholders entitled to vote at the Meeting?

A complete list of stockholders entitled to vote at the Meeting will be available for examination by the Company'sCompany’s stockholders for any purpose germane to the Meeting during regular business hours, for a period of ten days prior to the Meeting during regular business hours, at the Company'sCompany’s principal place of business at 7900 Harkins Road, Lanham, Maryland 20706. If our headquarters are closed for health and atsafety reasons related to the Meeting.coronavirus (COVID-19) pandemic during such period, the list of stockholders will be made available for inspection upon request via email to: investorinfo@2u.com subject to our satisfactory verification of stockholder status. During the Meeting, the list of stockholders will be made available at: www.virtualshareholdermeeting.com/TWOU2020.

What constitutes a quorum to transact business at the Meeting?

Before any business may be transacted at the Meeting, a quorum must be present. The presence at the Meeting, in person

(virtually) or by proxy, of the holders of a majority

in voting power of the

outstanding shares

outstanding andof stock entitled to vote

on the record date will constitute a quorum. At the close of business on the record date,

46,412,76163,958,768 shares were issued and outstanding. Proxies received but marked as abstentions and broker

non-votesnon‑votes will be included in the calculation of the number of shares considered to be present at the Meeting for purposes of a quorum.

What is the recommendation of the Board of Directors?

Our Board recommends a vote

"FOR"“FOR” the election of

three (3)each of the four Class

IIIII directors, nominated by the Board, to serve on the Board until the

Company's 2019Company’s 2023 annual meeting of stockholders and until their successors are duly elected and qualified or until their earlier death, resignation or removal;

"FOR"“FOR” the ratification of the appointment of KPMG LLP as the

Company'sCompany’s independent registered public accounting firm for the

20162020 fiscal

year; "FOR"year and “FOR” the approval, on a

non-bindingnon‑binding advisory basis, of the compensation of the

Company'sCompany’s Named Executive

Officers; and for "ONE YEAR" for the Company's frequency of non-binding "say on pay" advisory vote.Officers.

What vote is required to approve each item?

Directors named in Proposal One are elected by a plurality

For each of the

votes cast atproposals, the

Meeting,applicable voting recommendation, and

the director nominees who receive the greatest numbertreatment of

votes at the Meeting (up to the number of directors to be elected) will be elected. You may vote "FOR" or "WITHHELD" with respect to election of directors. Shares will be voted, if authority to do so is not withheld, for election of the Board's nominees named in Proposal One. Only votes "FOR" or "WITHHELD" are counted in determining whether a plurality has been cast in favor of a director. Broker non-votes, if any, will not affect the outcome of the vote on the election of directors. The affirmative vote of at least a majority in voting power of the shares present, in person or by proxy, at the Meeting and entitled to vote on Proposal Two will be required to ratify the appointment of KPMG LLP as the Company's independent registered public accounting firm for the 2016 fiscal year. Abstentions will have the same effect as votes "AGAINST" Proposal Two.

Table of Contents

The affirmative vote of at least a majority in voting power of the shares present, in person or by proxy, at the Meeting and entitled to vote on Proposal Three will be required to approve the compensation of our Named Executive Officers. Abstentions will have the same effect as votes "AGAINST" Proposal Three.

The affirmative vote of at least a majority in voting power of the shares present, in person or by proxy, at the Meeting and entitled to vote on Proposal Four will be required to determine the frequency of every year, every two years or every three years for the advisory vote on compensation of our Named Executive Officers. Abstentions will have the same effect as votes "AGAINST" any frequency.

The affirmative vote of at least a majority in voting power of the shares present, in person or by proxy, at the Meeting and entitled to vote will be required to approve any stockholder proposal. Under applicable Delaware law, in determining whether any stockholder proposal has received the requisite number of affirmative votes, abstentions and broker non-votes will be counted and will have the same effectbroker-non votes are as a vote against any stockholder proposal.

As noted above, a "broker non-vote"follows:

|

| | | | |

| Voting Item | Voting Standard | Treatment of Abstentions | Treatment of Broker Non-Votes |

| 1 | Election of Directors | Plurality of votes cast, with director nominees who receive the greatest number of votes at the Meeting (up to the number of directors to be elected) being elected | N/A | No effect |

| 2 | Ratification of Appointment of KPMG LLP | Majority of votes present or represented by proxy at the Meeting | Same effect as votes “AGAINST” | Not applicable as brokers generally have discretion to vote uninstructed shares on this proposal |

| 3 | Advisory Vote to Approve Compensation of Named Executive Officers | Majority of votes present or represented by proxy at the Meeting | Same effect as votes “AGAINST” | No effect |

A “broker non‑vote” occurs when a broker, bank or other holder of record holding shares for a beneficial owner does not vote on a particular proposal because that holder does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. If you are a beneficial owner, your broker, bank or other holder of record is permitted to vote your shares on

"routine"“routine” matters even if the record holder does not receive voting instructions from you. Absent instructions from you, the record holder may not vote on any

"non-routine"“non‑routine” matter, including the election of directors and

any stockholder proposal.the approval, on a non‑binding advisory basis, of the compensation of the Company’s Named Executive Officers. Without your voting instructions, a broker

non-votenon‑vote will occur.

An "abstention" occurs at the Meeting if your shares are deemed to be present at the Meeting, either because you attend the Meeting or because you have properly completed and returned a proxy, but you do not vote on any proposal or other matter which is required to be voted on by our stockholders at the Meeting, or, when applicable, if you specify that you wish to "abstain" from voting on an item. You should consult your broker if you have questions about this. What does it mean if I receive more than one proxy or voting instruction card?

It means your shares are registered differently or are in more than one account. Please provide voting instructions for all proxy and voting instruction cards you receive.

Where can I find the voting results of the Meeting?

We will announce preliminary voting results at the Meeting and will publicly disclose results in a Current Report on Form

8-K8‑K within four business days after the date of the Meeting.

Who will count the votes?

A representative

of American Stock Transfer & Trust Company, our transfer agent,from Broadridge Financial Solutions will both tabulate the votes and serve as the inspector of election.

Who will pay for the cost of this proxy solicitation?

We will bear the costs of soliciting proxies. We are making this solicitationsoliciting proxies for the Meeting in the following ways:

Our directors, officers and willemployees may, without additional pay, the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials. In addition to the mailing of these proxy materials, the solicitation ofsolicit proxies or votes may be made in person, by telephone or by electronic communication bycommunication.

We have also retained a third-party proxy consultant, Innisfree M&A Incorporated, to solicit proxies on our directors, officers and employees, who will not receive any additional compensationbehalf for such solicitation activities. a fee of approximately $25,000.

We will request banks, brokers, nominees, custodians and other fiduciaries who

Table of Contents

hold shares in street name to forward these proxy solicitation materials to the beneficial owners of those shares, and we will reimburse them the reasonable out-of-pocketout‑of‑pocket expenses they incur in doing so.

How can I access the Company's proxy materials

When are stockholder proposals and

annual report electronically? A copy of our Annual Report on Form 10-Kdirector nominations due for the fiscal year ended December 31, 2015 as filed with the United States Securities and Exchange Commission ("SEC") on March 10, 2016 is being mailed concurrently with this proxy statement to all stockholders entitled to notice of and to vote at the Meeting. A copy of our Annual Report on Form 10-K and these proxy materials are available without charge athttp://investor.2u.com/. References to our website in this proxy statement are not intended to function as hyperlinks, and the information contained on our website is not intended to be incorporated into this proxy statement. These proxy materials are also available in print to stockholders without charge and upon request, addressed to 2U, Inc., 8201 Corporate Drive, Suite 900, Landover, Maryland 20785, Attention: Corporate Secretary. You are encouraged to access and review all of the important information contained in the proxy materials before voting.

May I propose actions for consideration at next year'syear’s annual meeting of stockholders?

Any proposals that our stockholders wish to have included in our proxy statement and form of proxy for the 20172021 annual meeting of stockholders pursuant to Rule 14a‑8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) must be received by us no earlier than the close of business on February 7, 2017 and no later than the close of business on March 9, 2017January 1, 2021 and must otherwise comply with the requirements of Rule 14a-8 under14a‑8.

For proposals or nominations outside of Rule 14a‑8, the Securities Exchange Act of 1934 (the "Exchange Act"). The Company'sCompany’s amended and restated bylaws (the "“Bylaws"”) provide that, in order for a stockholder to propose any matter for considerationnominate a director or bring a proposal before the stockholders at an annual meeting of the Company other than matters set forth in the Notice of Meeting, such stockholder must have delivered timely prior written notice to the Secretary of the Company at the principal executive offices of the Company not later than the close of business on the ninetieth (90th) dayMarch 25, 2021 nor earlier than the close of business on the one hundred twentieth (120th) day prior to the first anniversary of the preceding year's annual meeting.February 23, 2021. In the event that the date of the annual meeting is advanced more than twenty-five (25)25 days prior to or delayed by more than twenty-five (25)25 days after the anniversary of the

preceding year'syear’s annual meeting, notice by the stockholder to be timely must be so received notno earlier than the close of business on the one hundred twentieth (120120th) day prior to such annual meeting and not later than the close of business on the later of the ninetieth (9090th) day prior to such annual meeting or the tenth (10th) day following the day on which the public announcement of the date of such meeting is first made. In no event shall an adjournment or a postponement of an annual meeting for which notice has been given, or the public announcement thereof has been made, commence a new time period for the giving of a stockholder'sstockholder’s notice as described above. Such Stockholders are also advised to review our Bylaws, which contain additional requirements about advance notice must contain certain information about such businessof stockholder proposals and the stockholder who proposes to bring the business before the meeting, including: (A) the name and address of each proponent of the proposal ("Proponent"), as it appears on the Company's books; (B) the class, series and number of shares of the Company that are owned beneficially and of record by each Proponent; (C) a description of any agreement, arrangement or understanding (whether oral or in writing) with respect to such nomination or proposal between or among any Proponent and any of its affiliates or associates, and any others (including their names) acting in concert, or otherwise under the agreement, arrangement or understanding, with any of the foregoing; (D) a representation that the Proponents are holders of record or beneficial owners, as the case may be, of shares of the Company entitled to vote at the meeting and intend to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice (with respect to a notice under Section 5(b)(1)director nominations. A copy of the Bylaws of the Company) or to propose the business that is specified in the notice (with respect to a notice under Section 5(b)(2) of the Bylaws of the Company); (E) a representation as to whether the Proponents intend to deliver a proxy statement and form of proxy to holders of a sufficient number of holders of

Table of Contents

the Company's voting shares to elect such nominee or nominees (with respect to a notice under Section 5(b)(1) of the Bylaws of the Company) or to carry such proposal (with respect to a notice under Section 5(b)(2) of the Bylaws of the Company); (F)can be obtained without charge by written request to the extent known by any Proponent, the nameCorporate Secretary, 7900 Harkins Road, Lanham, Maryland 20706 and address of any other stockholder supporting the proposalis available without charge on the date of such stockholder's notice; (G) a description of all Derivative Transactions (as defined in the Bylaws of the Company) by each Proponent during the previous twelve (12) month period, including the date of the transactions and the class, series and number of securities involved in, and the material economic terms of, such Derivative Transactions; (H) a representation and agreement that such Proponent (1) is not and will not become a party to any agreement, arrangementCompany’s website at: http://investor.2u.com.

Any proposals or

understanding with, and has not given any commitment or assurance to, any person or entity as to how such person, if elected as a director of the Company, will act or vote on any issue or question, (2) is not and will not become a party to any agreement, arrangement or understanding with any person or entity other than the Company with respect to any direct or indirect compensation, reimbursement or indemnification in connection with service or action as a director of the Company that has not been disclosed to the Company in such representation and agreement and (3) in such person's individual capacity, would be in compliance, if elected as a director of the Company, and will comply with, all applicable publicly disclosed confidentiality, corporate governance, conflict of interest, Regulation FD, code of conduct and ethics, and stock ownership and trading policies and guidelines of the Company; and (I) any other information relating to such person that would be required to be disclosed in a proxy statement or other filings required to be made in connection with solicitations of proxies for election of directors pursuant to Section 14 of the Exchange Act, and the rules and regulations promulgated thereunder. Any proposalsnotices should be sent to:

2U, INC.

8201 CORPORATE DRIVE, SUITE 900

LANDOVER,

7900 HARKINS ROAD

LANHAM, MARYLAND 20785

20706

ATTENTION: CORPORATE SECRETARY

NO PERSON IS AUTHORIZED TO GIVE ANY INFORMATION OR TO MAKE ANY REPRESENTATION OTHER THAN THOSE CONTAINED IN THIS PROXY STATEMENT AND, IF GIVEN OR MADE, SUCH INFORMATION MUST NOT BE RELIED UPON AS HAVING BEEN AUTHORIZED, ANDAUTHORIZED. THE DELIVERY OF THIS PROXY STATEMENT SHALL UNDER NO CIRCUMSTANCES CREATE ANY IMPLICATION THAT THERE HAS BEEN NO CHANGE IN THE AFFAIRS OF THE COMPANY SINCE THE DATE OF THIS PROXY STATEMENT.

Table of Contents

|

|

PROPOSAL ONE— ELECTION OF DIRECTORS |

Pursuant to the Company’s Amended and Restated Certificate of Incorporation, the Board is “classified,” which means that it is divided into three classes of directors based on the expiration of their terms. Under the classified board arrangement, directors are elected to terms that expire on the annual meeting date three years following the annual meeting at which they were elected, and the terms are “staggered” so that the terms of approximately one‑third of the directors expire each year. We believe having a staggered Board divided by classes is in the best interest of both the Company and its stockholders because it provides for greater stability and continuity on our Board. The Board, upon recommendation of the Nominating and Corporate Governance Committee, has nominated the following Class III directors to hold office until the 2023 Annual Meeting of Stockholders and until their respective successors have been duly elected and qualified or until their earlier death, resignation or removal: • Sallie L. Krawcheck; • John M. Larson; • Edward S. Macias; and • Alexis Maybank. All nominees currently serve as Class III directors of the Company. Each nominee has consented to serve as a director if elected at the Meeting. Should a nominee become unavailable to accept election as a director, the persons named in the enclosed proxy will vote the shares that such proxy represents for the election of such other person as the Board may nominate. We have no reason to believe that any of the nominees will be unable to serve. |

| THE BOARD OF DIRECTORS RECOMMENDS VOTING “FOR” THE ELECTION OF EACH OF THE FOUR CLASS III DIRECTOR NOMINEES. |

PROPOSAL ONE—

ELECTION OF DIRECTORS

There are currently ten members of our Board. Pursuant to the Company's Amended and Restated Certificate of Incorporation, the Board is "classified," which means that it is divided into three classes of directors based on the expiration of their terms. Under the classified board arrangement, directors are elected to terms that expire on the annual meeting date three years following the annual meeting at which they were elected, and the terms are "staggered" so that the terms of approximately one-third of the directors expire each year. At the Meeting, our stockholders will elect three directors to hold office until the 2019 annual meeting of stockholders and until their respective successors have been duly elected and qualified or until their earlier death, resignation or removal. Accordingly, this Proposal One seeks the election of three directors, Timothy M. Haley, Earl Lewis and Coretha M. Rushing, as Class II directors whose terms would expire in 2019.

Timothy M. Haley and Earl Lewis currently serve as Class II directors of the Company. The Board, upon recommendation of the Nominating and Corporate Governance Committee, has nominated Timothy M. Haley and Earl Lewis to serve again as Class II directors and has nominated Coretha M. Rushing to replace Michael T. Moe and serve as a Class II director until the 2019 annual meeting of stockholders and until their respective successors have been duly elected and qualified or until their earlier death, resignation or removal. Each nominee has consented to serve as a director if elected at the Meeting. Should a nominee become unavailable to accept election as a director, the persons named in the enclosed proxy will vote the shares that such proxy represents for the election of such other person as the Board may nominate. We have no reason to believe that any of the nominees will be unable to serve.

THE

OUR BOARD OF DIRECTORS

RECOMMENDS VOTING "FOR" THE ELECTION OF THETHREE CLASS II DIRECTOR NOMINEES. Our Board currently consists of 12 members. Set forth below is certain information concerning each nominee for election as a director at the Meeting and each director whose current termwith terms expiring at the 2021 or 2022 annual meetings of office will continue after the Meeting. stockholders. |

| | | |

| Director Name | Age | Class and Position | Term Expires |

| Paul A. Maeder | 66 | Class I Director and Chair of the Board | 2021 |

| Robert M. Stavis | 57 | Class I Director | 2021 |

| Christopher J. Paucek | 49 | Class I Director | 2021 |

| Gregory K. Peters | 49 | Class I Director | 2021 |

| Timothy M. Haley | 65 | Class II Director | 2022 |

| Valerie B. Jarrett | 63 | Class II Director | 2022 |

| Earl Lewis | 64 | Class II Director | 2022 |

| Coretha M. Rushing | 64 | Class II Director | 2022 |

| Sallie L. Krawcheck | 55 | Class III Director | 2020 |

| John M. Larson | 68 | Class III Director | 2020 |

| Edward S. Macias | 76 | Class III Director | 2020 |

| Alexis Maybank | 45 | Class III Director | 2020 |

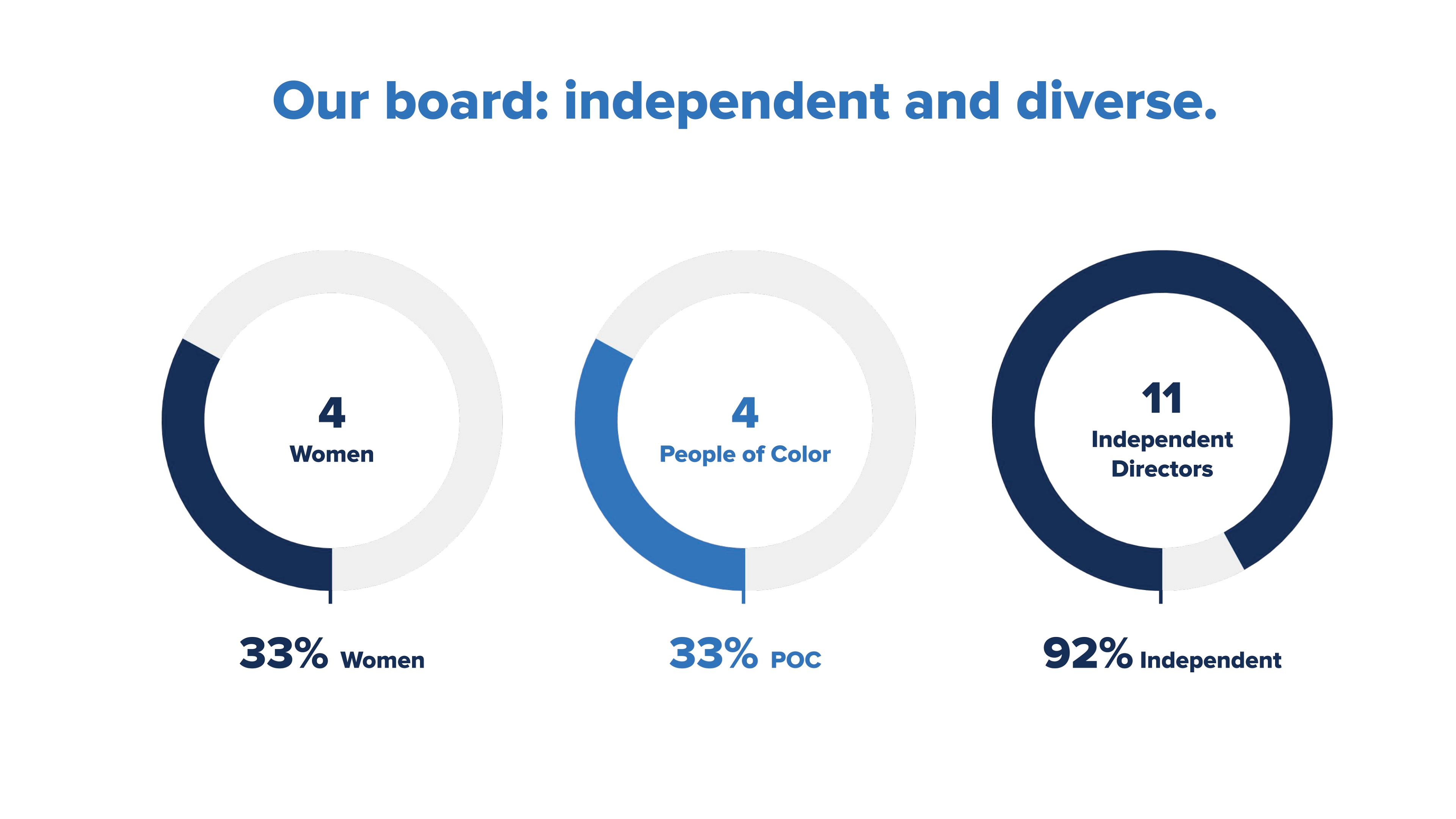

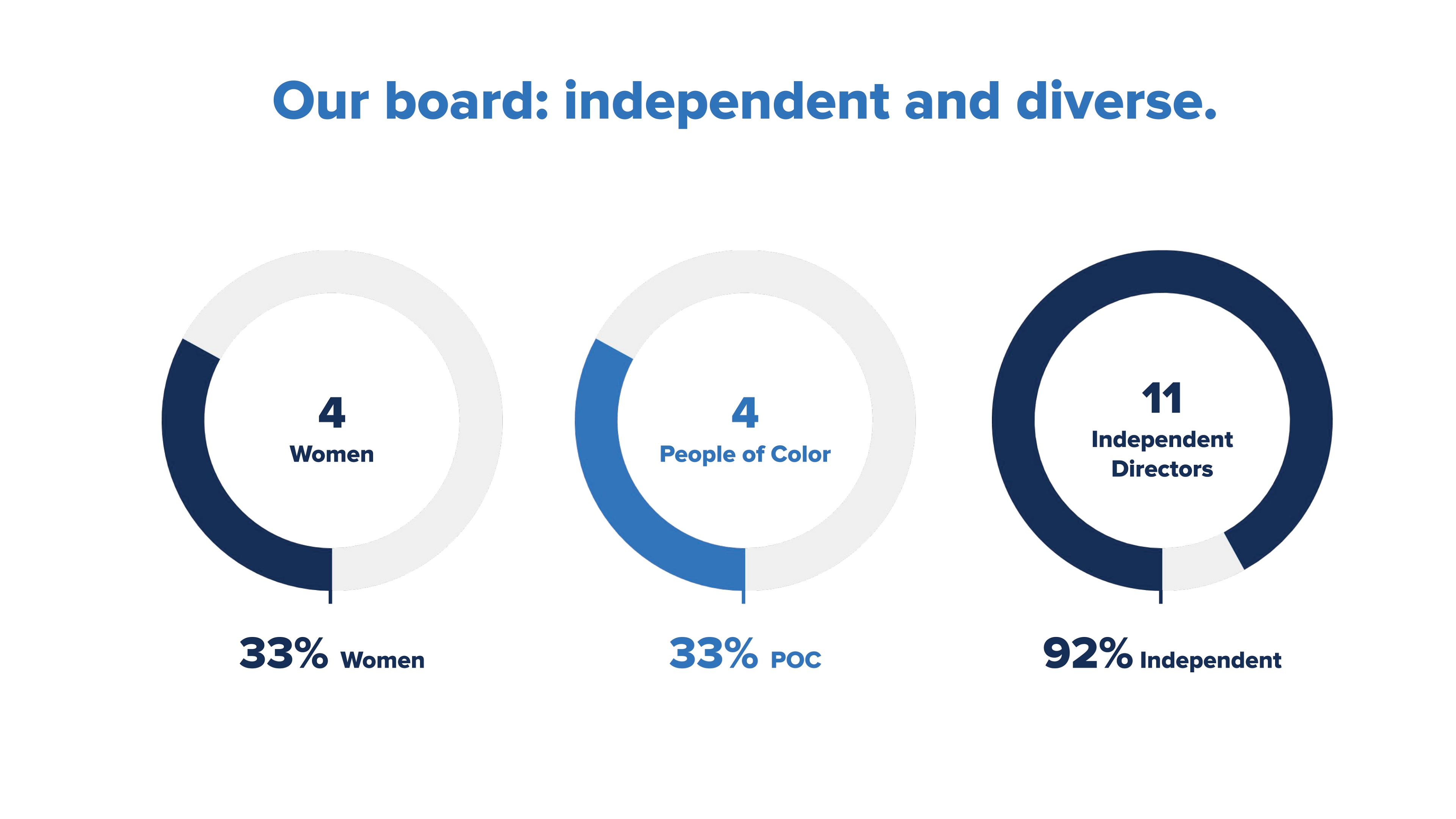

Other than our Chief Executive Officer, our Board is comprised of all independent directors. We believe it is essential to have directors representing diversity in many areas, including but not limited to race, ethnicity, gender, background, and professional experience. Our board is 50% ethnic or gender diverse and we are proud to have been named a “Winning ‘W’” company by 2020 Women on Boards for having a Board comprised at least 20% of women.

Each of our directors brings to our Board a wealth of varied experience derived from service as executives, financial experts, subject experts and/or industry leaders. They also all bring extensive board experience. Specific individual qualificationsWe have worked hard to ensure diversity of backgrounds and skills of eachperspectives within the board room, which we believe enhances oversight of our directors that contribute to the Board's effectiveness asbusiness strategy and our corporate governance practices. The table below sets forth a whole are described in the following paragraphs. For more information on the criteria used in nominating directors, see "Board of Directors and Committees—Nomination of Directors" below. | | | | | |

Name

| | Age | | Class and Position |

|---|

Paul A. Maeder

| | | 61 | | Class I Director and Chairman of the Board |

Robert M. Stavis

| | | 52 | | Class I Director |

Christopher J. Paucek

| | | 44 | | Class I Director |

Timothy M. Haley

| | | 60 | | Class II Director |

Earl Lewis

| | | 59 | | Class II Director |

Coretha M. Rushing

| | | 60 | | Class II Director |

Sallie L. Krawcheck

| | | 50 | | Class III Director |

Mark J. Chernis

| | | 48 | | Class III Director |

John M. Larson

| | | 63 | | Class III Director |

Edward S. Macias

| | | 71 | | Class III Director |

Class II—Directors with Terms Expiring in 2016

Timothy M. Haley. Mr. Haley has served on our Board since February 2010. Mr. Haley is a founding partner of Redpoint Ventures, a venture capital firm, and has been a Managing Director of the firm since 1999. Mr. Haley was also the managing director of Institutional Venture Partners, a

Table of Contents

venture capital firm, from 1998 to 2010. From 1986 to 1998, Mr. Haley was the president of Haley Associates, an executive recruiting firm in the high technology industry. Mr. Haley currently serves on the board of directors of Netflix, Inc. and several private companies. Mr. Haley holds a B.A. from Santa Clara University. Our Board believes that Mr. Haley's broad experience investing in software, consumer Internet and digital media industries, and his experience serving as a board member for numerous companies, enable him to make valuable contributions to the Board.

Earl Lewis. Dr. Lewis was appointed to our Board at the time of the initial public offering of the Company's shares. Since March 2013, Dr. Lewis has been the President of The Andrew W. Mellon Foundation, a philanthropic organization committed to advancing higher education, the arts and civil society. From January 2013 to March 2013, he served as President-designate of the Mellon Foundation. Prior to joining the Mellon Foundation, Dr. Lewis served as Provost and Executive Vice President of Academic Affairs at Emory University from 2004 to December 2012. He also held a variety of faculty positions at the University of California at Berkeley and the University of Michigan from 1984 through 2004, and served as Vice Provost for Academic Affairs—Graduate Studies and dean of the Horace H. Rackham School of Graduate Studies at the University of Michigan from 1998 to 2004. Dr. Lewis holds a B.A. from Concordia College and a M.A. and Ph.D. from the University of Minnesota. Our Board believes that Dr. Lewis's broad experience in academia, both as a faculty member and as an administrator at leading universities, will allow him to make valuable contributions to the Board.

Coretha M. Rushing. Ms. Rushing was nominated by our Board for election at the Meeting. She has been Corporate Vice President and Chief Human Resources Officer of Equifax Inc. since 2006. Prior to joining Equifax, she served as an executive coach and HR Consultant with Atlanta-based Cameron Wesley LLC. Prior to joining Cameron Wesley, she was Senior Vice President of Human Resources of The Coca-Cola Company, where she was employed from 1996 until 2004. Prior to that, she worked in a number of senior level positions in Pizza Hut (a division of PepsiCo) and IBM. She is currently the Board chair designate for the Society of Human Resource Management, a 300,000 membership organization whose membership is comprised of global human resource professionals. For the years 2017 and 2018, she will be the Chairman of the Board. Ms. Rushing holds a B.A. in industrial psychology from East Carolina University and a master's degree in human resources from the Society of Human Resource Management. Our Board believes that Ms. Rushing's broad experience in human resources at leading Fortune 500 companies, will allow her to make valuable contributions to the Board.

CONTINUING DIRECTORS

Class I—Directors with Terms Expiring in 2018

Paul A. Maeder. Mr. Maeder has served on our Board since February 2010 and as chairmansummary of our Board since November 2012. Mr. Maeder is a General Partner of Highland Capital Partners, a venture capital firm he co-founded in 1988. He currently serves on the boards of several private companies. He holds a B.S.E. in Aerospacedirector’s skills and Mechanical Sciences from Princeton University, an M.S.E. in Mechanical Engineering from Stanford University and a M.B.A. from the Harvard Business School. Our Board believes that Mr. Maeder's broad experience investing in the online higher education and software industries and his experience serving as a board member for numerous companies enable him to make valuable contributions to the Board.experience.

Robert M. Stavis. Mr. Stavis has served on our Board since April 2011. Mr. Stavis has been a partner at Bessemer Venture Partners, a venture capital firm, since 2000. Prior to joining Bessemer, Mr. Stavis was an independent private equity investor. Prior to that, he served in various positions at Salomon Smith Barney, including as co-head of global arbitrage trading. Mr. Stavis holds a B.A.S. in Engineering from the University of Pennsylvania's School of Engineering and Applied Sciences and a B.S. in Economics from the University of Pennsylvania's Wharton School. Our Board believes that

BIOGRAPHIES OF OUR BOARD OF DIRECTORS

Table of Contents

Mr. Stavis's broad experience investing in the emerging software technology industry and his experience serving as a board member for numerous companies enable him to make valuable contributions to the Board.

Christopher J. Paucek. Mr. Paucek is a co-founder of the Company and has served as our Chief Executive Officer since January 2012 and as a member of our Board since March 2012. He previously served as our President and Chief Operating Officer from April 2008 through December 2011. Prior to 2U, Mr. Paucek served as the chief executive officer of Smarterville, Inc., the parent company of Hooked on Phonics, from 2007 until 2008. From 2004 to 2007, Mr. Paucek served as vice president of business development and president of Educate Products for Educate, Inc. In 2004, Mr. Paucek served as deputy campaign manager for the successful re-election campaign of United States Senator Barbara Mikulski. Mr. Paucek began his career in 1993 by co-founding Cerebellum Corporation, the media company behind the award-winning educational Standard Deviants television program and video series, and he led Cerebellum as co-chief executive officer until 2003. Mr. Paucek holds a B.A. from The George Washington University and is currently enrolled in our MBA@UNC program at the UNC Kenan-Flagler Business School of the University of North Carolina at Chapel Hill. Our Board believes that Mr. Paucek's knowledge of the Company as one of our co-founders, and his broad experience leading education companies, enable him to make valuable contributions to the Board.

Class III—Directors with Terms Expiring in

20172020

Sallie L. Krawcheck. Ms. Krawcheck was appointed to our Board as of the initial public offering of the Company's shares.Company’s shares in April 2014. Ms. Krawcheck has beenis the Chief Executive Officer and ownerco‑founder of Ellevate Asset Management,Ellevest, an investment firm focused on companies whereplatform for women make up a significant portion of officers and directors, since June 2014, and an owner of Ellevate Network (formerly 85 Broads), a professional women's networking organization, since May 2013.that was founded in 2016. Ms. Krawcheck was the President of Global Wealth & Investment Management for Bank of America from August 2009 to September 2011. Prior to joining Bank of America, Ms. Krawcheck held a variety of senior executive positions at Citigroup from 2002 to 2008, including Chief Executive Officer of its Smith Barney division, Chief Financial Officer of Citigroup and Chief Executive Officer and ChairmanChair of Citi Global Wealth Management. She served as a director of BlackRock Inc. from 2009 to 2011 and Dell Inc. from 2006 to 2009. Ms. Krawcheck holds a B.A. from the University of North Carolina at Chapel Hill and aan M.B.A. from Columbia University. Our Board believes that Ms. Krawcheck'sKrawcheck’s financial acumen and broad experience serving in leadership roles with financial and investment firms will allowenables her to make valuable contributions to the Board. Mark J. Chernis. Mr. Chernis has served on our Board since January 2009. Mr. Chernis joined Pearson in June 2011 following the acquisition of SchoolNet. He currently serves as the SVP of Strategic Partnerships and Investments and was previously the President and Chief Operating Officer of SchoolNet. Mr. Chernis has held various positions at The Princeton Review beginning in 1984, most recently serving as its President from 1995 to November 2007. Mr. Chernis holds a B.A. from Vassar College. Our Board believes that Mr. Chernis's deep knowledge of the higher education industry and his long-term experience serving as a member of the Board enables him to make valuable contributions to the Board.John M. Larson. Mr. Larson has served on our Board since June 2009. Mr. Larson has served as the Executive Chairman and Chief Executive OfficerChair of Triumph Higher Education Group, Inc., a culinary education company, since 2010. He also serveshas served as President of Triumph Group, Inc., a company that advises and invests in domestic and international education companies.companies, since 2008. Mr. Larson founded and served as President, Chief Executive Officer and director of Career Education Corporation, or CEC, a publicly held post-secondarypost‑secondary education company, from its inception in 1994 through his retirement from the company in 2006, including as ChairmanChair of the Board from 2000 to

Table of Contents

2006. He became ChairmanChair Emeritus of CEC in 2006 and continues to serve in that position. He holds a B.S. in Business Administration from the University of California at Berkeley. Our Board believes that Mr. Larson'sLarson’s deep knowledge of the higher education industry and his experience founding and leading a publicly held education company enable him to make valuable contributions to the Board.

Edward S. Macias. Dr. Macias has served on our Board since November 2014. Dr. Macias is currently the Provost Emeritus and Barbara and David Thomas Distinguished Professor Emeritus in Arts & Sciences at Washington University in St. Louis. Previously, Dr. Macias was the chief academic officer of Washington University in St. Louis for 25 years, before stepping down from his position as Provost and Executive Vice Chancellor in June 2013. During his tenure as Provost, Dr. Macias provided leadership in curriculum, budget and capital project development initiatives. Dr. Macias has broad experience and knowledge in higher education administration and innovation in academic settings. Following his tenure as Provost, Dr. Macias was nominated to lead the school'sschool’s effort to explore its approach to online education and to leverage advances in education technology to enhance its reach and impact. Dr. Macias currently serves on the boards of the Center for Research Libraries, theCasa de Salud, Shakespeare Festival of St. Louis Casa de Salud, Mary Institute and Saint Louis Country Day School, the St. Louis Immigration and Innovation Steering Committee and on the academic advisory board of the Schwarzman Scholars Program.Mosaic Project. He is an emeritus member of the boardboards of Colgate University.University and Mary Institute and St. Louis Country Day School. Dr. Macias holds a bachelor's degreeB.S. in Chemistry from Colgate University and a doctorate in Chemistry from Massachusetts Institute of Technology. Our Board believes that Dr. Macias'sMacias’s substantial knowledge of the higher education industry and his vast experience as Provost and Executive Vice Chancellor of Washington University in St. Louis enable him to make valuable contributions to the Board. Alexis Maybank. Ms. Maybank has served on our Board since December 2018. She is an internet entrepreneur and currently serves as a member of the Board of Girls Who Code. Ms. Maybank co‑founded Project September in 2016 and served as its Chief Executive Officer until December 2017. Prior to co‑founding Project September, she co‑founded Gilt Groupe and served as its founding Chief Executive Officer from 2007 to 2008 and in several other executive roles, including Chief Strategy Officer, Chief Marketing Officer and President of Gilt Home and Kids from 2008 to 2014. Prior to co‑founding Gilt Groupe in 2007, Ms. Maybank was General Manager of eCommerce for AOL Media Networks and served in various senior roles at eBay. Ms. Maybank holds a B.S. from Harvard University and an M.B.A. from Harvard Business School. Our Board believes that Ms. Maybank’s experience in e‑commerce and scaling rapidly growing technology companies enable her to make valuable contributions to the Board.

Class I—Directors with Terms Expiring at the 2021 Annual Meeting of Stockholders

Paul A. Maeder. Mr. Maeder has served on our Board since 2010 and as Chair of our Board since November 2012. Mr. Maeder is a General Partner of Highland Capital Partners, a venture capital firm he co‑founded in 1987. He currently serves on the boards of several private companies. Mr. Maeder served as a director of Imprivata, Inc. from February 2002 to July 2016 and of Carbon Black, Inc. from September 2015 to February 2019. He holds a B.S.E. in Aerospace and Mechanical Sciences from Princeton University, an M.S.E. in Mechanical Engineering from Stanford University and an M.B.A. from the Harvard Business School. Our Board believes that Mr. Maeder’s broad experience investing in the online higher education

and software industries and his experience serving as a board member for numerous companies enable him to make valuable contributions to the Board.

Robert M. Stavis. Mr. Stavis has served on our Board since 2011. Mr. Stavis has been a Partner at Bessemer Venture Partners, a venture capital firm, since 2000. He currently serves on the boards of several private companies. Prior to joining Bessemer, Mr. Stavis was an independent private equity investor. Prior to that, he served in various positions at Salomon Smith Barney, including as Co‑Head of Global Arbitrage Trading. Mr. Stavis holds a B.A.S. in Engineering from the University of Pennsylvania’s School of Engineering and Applied Sciences and a B.S. in Economics from the University of Pennsylvania’s Wharton School. Our Board believes that Mr. Stavis’s broad experience investing in the emerging software technology industry and his experience serving as a board member for numerous companies enable him to make valuable contributions to the Board.

Christopher J. Paucek. Mr. Paucek is a co‑founder of the Company and has served as our Chief Executive Officer and as a member of our Board since 2012. He previously served as our President and Chief Operating Officer from April 2008 through December 2011. Prior to 2U, Mr. Paucek served as the Chief Executive Officer of Smarterville, Inc., the parent company of Hooked on Phonics, from 2007 until 2008. From 2004 to 2007, Mr. Paucek served as Vice President of Business Development and President of Educate Products for Educate, Inc. In 2004, Mr. Paucek served as Deputy Campaign Manager for the successful reelection campaign of United States Senator Barbara Mikulski. Mr. Paucek began his career in 1993 by co‑founding Cerebellum Corporation, the media company behind the award‑winning educational Standard Deviants television program and video series, and he led Cerebellum as Co‑Chief Executive Officer until 2003. Mr. Paucek holds a B.A. from The George Washington University and an M.B.A. from the Kenan‑Flagler Business School of the University of North Carolina at Chapel Hill. Our Board believes that Mr. Paucek’s knowledge of the Company as one of our co‑founders, and his broad experience leading education companies, enable him to make valuable contributions to the Board.

Gregory K. Peters. Mr. Peters was appointed to our Board in March 2018. Mr. Peters joined Netflix, Inc. in 2008 and currently serves as the Chief Product Officer, responsible for designing, building and optimizing the customer experience. From 2015 to July 2017, Mr. Peters served as the International Development Officer of Netflix, responsible for global partnerships with consumer electronics companies, Internet service providers and multichannel video program distributors. From July 2013 to 2015, Mr. Peters served as the Chief Streaming and Partnerships Officer of Netflix. Prior to joining Netflix in 2008, Mr. Peters was Senior Vice President of Consumer Electronics Products for Macrovision Solutions Corp. (later renamed Rovi Corporation) and held positions at Mediabolic Inc., Red Hat Network and Wine.com. Mr. Peters holds a B.S. in Physics and Astrophysics from Yale University. Our Board believes that Mr. Peters’ technology and product expertise enable him to make valuable contributions to the Board.

Class II—Directors with Terms Expiring at the 2022 Annual Meeting of Stockholders

Timothy M. Haley. Mr. Haley has served on our Board since 2010. Mr. Haley is a founding partner of Redpoint Ventures, a venture capital firm, and has been a Managing Director of the firm since 1999. Mr. Haley was also the Managing Director of Institutional Venture Partners, a venture capital firm, from 1998 to 2010. From 1986 to 1998, Mr. Haley was the President of Haley Associates, an executive recruiting firm in the high technology industry. Mr. Haley currently serves on the board of directors of Netflix, Inc., Zuora Inc., and several private companies. Mr. Haley holds a B.A. from Santa Clara University. Our Board believes that Mr. Haley’s broad experience investing in software, consumer Internet and digital media industries, and his experience serving as a board member for numerous companies, enable him to make valuable contributions to the Board.

Earl Lewis. Dr. Lewis was appointed to our Board at the time of the initial public offering of the Company’s shares in April 2014. Dr. Lewis, a fellow of the American Academy of Arts and Sciences, is a Thomas C. Holt Distinguished Professor of History and AfroAmerican and African Studies and Public Policy at the University of Michigan and founding director of the Center for Social Solutions. From March 2013 to March 2018, Dr. Lewis served as President of The Andrew W. Mellon Foundation, a philanthropic organization committed to advancing higher education, the arts and civil society. From January 2013 to March 2013, he served as President‑designate of the Mellon Foundation. Prior to joining the Mellon Foundation, Dr. Lewis served as Provost and Executive Vice President for Academic Affairs at Emory University from 2004 to December 2012. He also held a variety of faculty positions at the University of California at Berkeley and the University of Michigan from 1984 through 2004, and served as Vice Provost for Academic Affairs—Graduate Studies and Dean of the Horace H. Rackham School of Graduate Studies at the University of Michigan from 1998 to 2004. Dr. Lewis holds a B.A. from Concordia College and an M.A. and Ph.D. from the University of Minnesota. Our Board believes that Dr. Lewis’s broad experience in academia, both as a faculty member and as an administrator at leading universities, allows him to make valuable contributions to the Board.

Coretha M. Rushing. Ms. Rushing has served on our Board since 2016. She has been the President of CR Consulting since June 2019. Prior to that, she served as Corporate Vice President and Chief Human Resources Officer of Equifax Inc. from May 2006 to December 2019. Prior to joining Equifax, she served as an Executive Coach and HR Consultant with Atlanta‑based Cameron Wesley LLC. Prior to joining Cameron Wesley, she was Senior Vice President, Chief Human Resources Officer of The Coca‑Cola Company, where she was employed from 1996 until 2004. Prior to that, she worked in a number of senior level positions in Pizza Hut (a division of PepsiCo) and IBM. She was Chair of the Board for the Society of Human Resource Management until January 2019, an organization of approximately 300,000 global human resource professionals and is currently serving as Chair Emeritus. Ms. Rushing holds a B.S. in Industrial Psychology from East Carolina University and an M.S. in Education from The George Washington University. Our Board believes that Ms. Rushing’s broad experience in human resources at leading Fortune 500 companies, enables her to make valuable contributions to the Board.

Valerie B. Jarrett. Ms. Jarrett has served on our Board since December 2017. She is an acclaimed civic leader, business executive and attorney. She currently serves as a Senior Advisor to the Obama Foundation and Attn: and is a Distinguished Senior Fellow at the University of Chicago Law School. She also serves as a director on the boards of Ariel Investments and Lyft. During the Obama administration, from January 2008 to January 2016, Ms. Jarrett served as Senior Advisor to the President of the United States, where she oversaw the Office of Public Engagement and Intergovernmental Affairs and chaired the White House Council on Women and Girls. Prior to joining the Obama administration, Ms. Jarret was co‑chair of the Obama‑Biden transition team. Ms. Jarrett began her career in politics in 1987, working as Deputy Corporation Counsel for Finance and Development in the administration of Mayor Harold Washington in Chicago. She subsequently was Deputy Chief of Staff for Mayor Richard M. Daley and later served as Commissioner of the Department of Planning and Development and chaired the Chicago Transit Board. From 1995 until she joined the Obama administration, Ms. Jarrett served in various senior positions, including Chief Executive Officer, of the Habitat Company, a Chicago real estate development and management firm. She has also served on numerous corporate and civic boards, including Chair of the Board of Trustees of the University of Chicago Medical Center, Chair of the Board of Trustees of the University of Chicago, Chair of the Board of the Chicago Stock Exchange and was a director of the Federal Reserve Bank of Chicago. Ms. Jarrett holds a B.A. from Stanford University and a J.D. from the University of Michigan Law School. Our Board believes that Ms. Jarrett’s broad experience in public policy enables her to make valuable contributions to the Board.

BOARD OF DIRECTORS AND COMMITTEES

Board Purpose and Structure

The mission of the Board is to provide strategic guidance to the

Company'sCompany’s management, to monitor the performance and ethical behavior of the

Company'sCompany’s management, and to maximize the

long-termlong‑term financial return to the

Company'sCompany’s stockholders, while considering and appropriately balancing the interests of other stakeholders and constituencies. The Board is

constitutedcomprised of

tentwelve directors. The authorized number of directors may be changed only by resolution approved by a majority of our Board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of

one-thirdone‑third of the directors. The division of our Board into three classes with staggered

three-yearthree‑year terms may delay or prevent a change in our management or a change of control.

The Board has established standing committees in connection with the discharge of its responsibilities. These committees include an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. The Board has adopted written charters for each of these committees.

In January 2019, the Board established a Transaction Committee to assist the Board in its review and consideration of the acquisition of Trilogy in addition to other potential strategic acquisition opportunities.

Our Board currently has an independent

chairman,Chair, Mr. Maeder, who has the authority, among other things, to call and preside over Board meetings, including meetings of the independent directors, and to set meeting agendas. Accordingly, the

Chair of the Board

chairman has substantial ability to shape the work of the Board. We believe that separation of the positions of

Chair of the Board

chairman and

chief executive officerChief Executive Officer reinforces the independence of the Board in its oversight of the business and affairs of the Company. In addition, we believe that having an independent

Chair of the Board

chairman creates an environment that is more conducive to objective evaluation and oversight of

management'smanagement’s performance, increasing management accountability and improving the ability of the Board to monitor whether

management's

Table of Contents

management’s actions are in the best interests of the Company and its

stockholders. As a result, we believe that having an independent

Chair of the Board

chairman enhances the effectiveness of the Board as a whole.

The Board oversees a

company-widecompany‑wide approach to risk management that is carried out by management. The Board determines the appropriate risk for us generally, assesses the specific risks faced by us and reviews the steps taken by management to manage those risks. While the Board maintains the ultimate oversight responsibility for the risk management process, its committees oversee risk in certain specified areas.

Our Compensation Committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements, and the incentives created by the compensation awards it administers. Our Audit Committee oversees management of enterprise risks,

financial risks, and

financiallegal and compliance risks, as well as potential conflicts of interest. Our Nominating and Corporate Governance Committee is responsible for overseeing the management of risks associated with the independence of our

Board.Board and the Company’s corporate governance practices.

Management has responsibility for the direct management and oversight of legal, financial, cybersecurity, privacy and commercial compliance matters, which includes identifying areas of risk and implementing policies, procedures and practices to mitigate the identified risks. Management provides regular reports to the Audit Committee concerning financial, tax, legal and compliance related risks and the Company’s experts report to the Board on cybersecurity.

Our Nominating and Corporate Governance Committee and our Board have undertaken a review of the independence of our current directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. As a result of this review, our Nominating and Corporate Governance Committee and our Board determined that Messrs. Chernis, Haley, Larson, Maeder, Moe, Stavis, Lewis, Macias, Maeder, Peters and Ms.Stavis, and Mses. Jarrett, Krawcheck, Maybank and Rushing, representing nineeleven of our tentwelve current directors, are "independent“independent directors,"” as defined under applicable NASDAQ rules. Additionally, our NominatingNasdaq listing standards and Corporate Governance Committeethe rules of the United States Securities and our Board have determined that director nominee Ms. Rushing would qualify as an "independent director," as defined under applicable NASDAQ rules.Exchange Commission (“

SEC”). The Nominating and Corporate Governance Committee and the Board apply standards in affirmatively determining whether a director is

"independent,"“independent,” in compliance with applicable

SEC rules and the rules andNasdaq listing standards

of NASDAQ.and SEC rules. As part of the process in making such determination, the Nominating and Corporate Governance Committee and the Board also determined that none of

current directors Messrs.

Chernis, Haley, Larson,

Maeder, Moe, Stavis, Lewis, Macias,

Maeder, Peters and

Ms.Stavis, and Mses. Jarrett, Krawcheck,

nor director nominee Ms.Maybank, and Rushing have any other

"material relationship"“material relationship” with the Company that could interfere with his or her ability to exercise independent judgment.

The Board includes one management director, Mr. Paucek, who is the

Company'sCompany’s Chief Executive Officer. The Nominating and Corporate Governance Committee and the Board

hashave determined that Mr. Paucek is not independent under

the rules andapplicable Nasdaq listing standards

of NASDAQ.and SEC rules.

As part of its annual evaluation of director independence, the Nominating and Corporate Governance Committee and the Board examinesexamine (among other things) whether any transactions or relationships exist currently (or existed during the past three years) between each independent director and the Company, its subsidiaries, affiliates, equity investors, or independent auditors and the nature of those relationships under the relevant NASDAQapplicable Nasdaq listing standards and SEC standards.rules. The Nominating and Corporate Governance Committee and the Board also examine whether there are (or have been within the past year) any transactions or relationships between each independent director and any executive officer of the Company or its affiliates. As a result of this evaluation, the Nominating and Corporate Governance Committee and the Board have affirmatively determined that each independent director is independent under those criteria.

Table of Contents

Board Meetings and Attendance

During 2015,2019, including both regularly scheduled and special meetings, our Board met a total of seveneight times, the Audit Committee met a total of eight times, the Compensation Committee met a total of sevensix times, and the Nominating and Corporate Governance Committee met a total of threefour times and the Transaction Committee met a total of two times. During 2015, all2019, each of the Company'sCompany’s directors attended at least 75% of the aggregate of the total number of meetings of the Board. Additionally, in 2015, 100%Board that occurred while he or she was serving as a director and the total number of meetings held by any of the memberscommittees of the Audit Committee attended all of the meetings of

Board on which such

committee, 100% of the members of the Compensation Committee attended all of the meetings of such committee and 100% of the members of the Nominating and Corporate Governance Committee attended all of the meetings of such committee.director served. During

threeseven meetings of the Audit Committee, the Audit Committee met privately with the

Company'sCompany’s independent registered public accounting firm.

|

| | |

| Members | Independent | |

| Robert M. Stavis (Chair) | ü | Meetings during 2019: 8 |

| Earl Lewis | ü | Report of the Audit Committee: Page 31 |

| Paul A. Maeder | ü | |

| Gregory K. Peters | ü | |

The current composition of our Audit Committee reviews our internal accounting procedures and consults with and reviews the services provided by our independent registered public accountants. Our Audit Committee consists of three directors, Ms. Krawcheck andis set forth above. Mr. Chernis and, through April 1, 2015, Mr. Haley. Effective as of April 1, 2015, Mr. Moe replaced Mr. Haley as a member ofMaeder joined the Audit Committee uponon April 25, 2019 to replace Ms. Maybank who served on the recommendation ofAudit Committee from January 19, 2019 to April 25, 2019 when she was appointed to the Nominating and Corporate Governance Committee and the Board. Ms. KrawcheckCompensation Committee. Mr. Stavis is the chairChair of the Audit Committee, and our Board has determined that shehe is an "audit“audit committee financial expert,"” as defined by SEC rules and regulations. Our Board has determined that the composition of our Audit Committee meets the criteria for independence under, and the functioning of our Audit Committee complies with, the applicable requirements of the Sarbanes-OxleySarbanes‑Oxley Act of 2002, the NASDAQNasdaq listing requirementsstandards and SEC rules and regulations. The Board has determined that all members of the Audit Committee are financially literate and possess "financial sophistication"“financial sophistication” within the meaning of the NASDAQNasdaq listing requirements. Mr. Haley is a Managing Director of Redpoint Ventures, affiliates of which beneficially owned, until March 10, 2016, more than 10% of our common stock. Therefore, we may not be able to rely upon the safe harbor position of Rule 10A-3 under the Exchange Act, which provides that a person will not be deemed to be an affiliate of a company if he or she is not the beneficial owner, directly or indirectly, of more than 10% of a class of voting equity securities of that company. However, prior to Mr. Haley's appointment to the Audit Committee, our Board made an affirmative determination that Mr. Haley is not an affiliate of our Company.standards. We intend to continue to evaluate the requirements applicable to us, and we intend to comply with the future requirements to the extent that they become applicable to our Audit Committee.

Our Audit Committee oversees the Company’s corporate accounting and financial reporting processes. The principal duties and responsibilities of our Audit Committee include:

appointing and retaining an independent registered public accounting firm to serve as independent auditor to audit our consolidated financial statements, overseeing and evaluating the independent auditor'sauditor’s work and determining the independent auditor'sauditor’s compensation;

•

approving in advance all audit services and non-auditnon‑audit services to be provided to us by our independent auditor;

•

establishing procedures for the receipt, retention and treatment of complaints received by us regarding accounting, internal accounting controls, auditing or compliance matters, as well as for the confidential, anonymous submission by our employees of concerns regarding questionable accounting or auditing matters;

•reviewing and discussing with management and our independent auditor the results of the annual audit and the independent auditor'sauditor’s review of our quarterly consolidated financial statements; and

Table of Contents

•- conferring with management and our independent auditor about the scope, adequacy and effectiveness of our internal accounting controls, the objectivity of our financial reporting and our accounting policies and practices.

The Audit Committee'sCommittee’s charter can be obtained without charge fromon the Company'sCompany’s website at at: http://investor.2u.com/investor.2u.com. As provided under the Audit Committee'sCommittee’s charter, the Audit Committee's pre-approvalCommittee’s pre‑approval policy and applicable law, the Audit Committee pre-approvespre‑approves all audit, review and attest services, as well as all permitted non-auditnon‑audit services (subject to ade minimis exception) to be provided by our independent registered public accounting firm. This pre-approvalpre‑approval applies to audit services, audit-relatedaudit‑related services, tax services and other services. Under this policy, the Audit Committee may provide pre-approvalpre‑approval for a particular defined task or scope of work, subject to a specific budget and for up to one year. The Audit Committee may also delegate pre-approvalpre‑approval authority to one or more of the Audit Committee'sCommittee’s members, and the Audit Committee has delegated to the chairChair of the Audit Committee the authority to pre-approvepre‑approve services (other than the annual engagement) up to a maximum of $50,000 per calendar year. The chairChair of the Audit Committee reports any pre-approvalpre‑approval decisions at the next scheduled meeting of the Audit Committee. To avoid potential conflicts of interest, applicable securities laws prohibit the Company as a publicly traded company from obtaining certain non-auditnon‑audit services from its independent audit firm. We obtain these services from other service providers as needed.

Compensation Committee

Our

|

| | |

| Members | Independent | |

| John M. Larson (Chair) | ü | Meetings during 2019: 6 |

| Alexis Maybank | ü | Report of the Compensation Committee: Page 51 |

| Coretha M. Rushing | ü | |

The current composition of our Compensation Committee

reviews and determinesis set forth above. Ms. Maybank joined the

compensation of all our executive officers. Our Compensation Committee

consists of three directors, Messrs. Larson, Stavis andon April 25, 2019 to replace Mr. Maeder

each of whom is a non-employee member of our Board, as defined in Rule 16b-3 underwho served on the

Exchange Act, and an "outside director," as defined under Section 162(m) of the Internal Revenue Code of 1986, as amended.Compensation Committee until April 25, 2019. Mr. Larson is the

chairChair of the Compensation Committee. Our Board has determined that the composition of our Compensation Committee satisfies the applicable independence requirements under, and the functioning of our Compensation Committee complies with the applicable requirements of,

NASDAQNasdaq listing

rulesstandards and SEC rules and regulations.

Each of Mses. Maybank and Rushing is also a “non‑employee director,” as defined in Rule 16b‑3 under the Exchange Act. We intend to continue to evaluate and intend to comply with all future requirements applicable to our Compensation Committee.

Our Compensation Committee oversees the Company’s compensation policies, plans and programs. The principal duties and responsibilities of our Compensation Committee include:

establishing and approving, and making recommendations to the Board regarding, performance goals and objectives relevant to the compensation of our chief executive officer, evaluating the performance of our chief executive officer in light of those goals and objectives and setting, or recommending to the full Board for approval, the chief executive officer'sofficer’s compensation, including incentive-basedincentive‑based and equity-basedequity‑based compensation, based on that evaluation;

•setting the compensation of our other executive officers, based in part on recommendations of the chief executive officer;

•Chief Executive Officer;exercising administrative authority under our stock plans and employee benefit plans;

•establishing policies and making recommendations to our Board regarding director compensation;

•reviewing and discussing with management the compensation discussion and analysis that we may be required from time to time to include in SEC filings; and

•preparing a Compensation Committee report on executive compensation as may be required from time to time to be included in our annual proxy statements or annual reports on Form

10-K10‑K filed with the SEC.

The scope of the Compensation Committee'sCommittee’s authority and responsibilities is set forth in its written charter, a copy of which is available without charge fromon the Company'sCompany’s website

at:

Table of Contentsat http://investor.2u.com/investor.2u.com. As provided under the Compensation Committee'sCommittee’s charter, the Compensation Committee may delegate its authority to special subcommittees as the Compensation Committee deems appropriate, consistent with applicable law and the NASDAQNasdaq listing rules.standards. In April 2019, our Compensation Committee formed a subcommittee comprised entirely of members of the Compensation Committee that meet the requirements of a “non‑employee director” as defined in Rule 16b‑3 of the Exchange Act. This subcommittee has the nonexclusive authority to grant equity and other awards under our compensation plans that comply with Section 16 of the Exchange Act. As part of its duties, the Compensation Committee establishes and approves (or refers to the full Board for approval) the compensation and performance of the Company'sCompany’s Chief Executive Officer in light of relevant corporate goals and objectives that are periodically established by the Compensation Committee or the Board. The Chief Executive Officer is not present during the voting and deliberations regarding his compensation. The Compensation Committee also reviews and approves (or refers to the full Board for review and approval) the compensation of the Company'sCompany’s executive officers other than the Chief Executive Officer in light of relevant corporate goals and objectives that are periodically established by the Compensation Committee or the Board. No executive officer is present during the voting and deliberations regarding his or her compensation. Under its charter, the Compensation Committee has the authority to retain, at the Company'sCompany’s expense, such counsel, consultants, experts and other professionals as it deems necessary.

For additional information regarding the role of executive officers and compensation consultants in setting director and executive compensation, see the section entitled “Compensation Discussion and Analysis.”

Compensation Committee Interlocks and Insider Participation

None of the members of

No director who served on the Compensation Committee

during 2019 is a former or current officer or employee of the Company or any of its

subsidiaries, nor did any of the members of the Compensation Committee have a relationship requiring disclosure under Item 404 of Regulation S-K promulgated under the Exchange Act.subsidiaries. In addition, during the last completed fiscal year, none of our executive officers has served as a member of the board of directors or compensation committee of any other entity that has or has had one or more of its executive officers serving as a member of our Board or Compensation Committee.

Nominating and Corporate Governance Committee

|

| | |

| Members | Independent | |

| Timothy M. Haley (Chair) | ü | Meetings during 2019: 4 |

| Edward S. Macias | ü | |

| Valerie Jarrett | ü | |

| Sallie L. Krawcheck | ü | |

The

current composition of our Nominating and Corporate Governance Committee

consists of three directors, Messrs. Haley and Lewis and, through April 1, 2015, Mr. Moe. Effective as of April 1, 2015, Dr. Macias replaced Mr. Moe as a member of the Nominating and Corporate Governance Committee, upon the recommendation of the Nominating and Corporate Governance Committee and the Board.is set forth above. Mr. Haley is the

chairChair of the Nominating and Corporate Governance Committee. Our Board has determined that the composition of our Nominating and Corporate Governance Committee satisfies the applicable independence requirements under, and the functioning of our Nominating and Corporate Governance Committee complies with the applicable requirements of,

NASDAQNasdaq listing standards and SEC rules and regulations. We

willintend to continue to evaluate and

willintend to comply with all future requirements applicable to our Nominating and Corporate Governance Committee.

TheOur Nominating and Corporate Governance

Committee'sCommittee oversees the Company’s corporate governance practices. The principal duties and responsibilities

of the Nominating and Corporate Governance Committee include:

assessing the need for new directors and identifying individuals qualified to become directors;

•recommending to the Board the persons to be nominated for election as directors and to each of the Board'sBoard’s committees;

•assessing individual director performance, participation and qualifications;

•developing and recommending to the Board corporate governance principles;

•monitoring the effectiveness of the Board and the quality of the relationship between management and the Board; and

•overseeing a periodic evaluation of the

Board'sBoard’s performance.

The Nominating and Corporate Governance Committee'sCommittee’s charter can be obtained without charge fromon the Company'sCompany’s website at at: http://investor.2u.com/investor.2u.com.

Table of Contents

Executive Sessions of

Non-ManagementNon‑Management Directors

In order to promote discussion among the non-managementnon‑management directors, the Board regularly scheduledholds executive sessions (i.e.(i.e., meetings of non-managementnon‑management directors without management present) are held to review such topics as the non-managementnon‑management directors determine. Mr. Maeder presides as Chairman at ourChair during the executive sessions.sessions of the Board. The non-managementnon‑management directors of the Board met in executive session five times during 2015.2019.

The Nominating and Corporate Governance Committee is responsible for identifying, screening and recommending candidates to the Board for Board membership. When formulating its recommendations, the Nominating and Corporate Governance Committee also considers advice and recommendations from others as it deems appropriate. The Nominating and Corporate Governance Committee is responsible for assessing the appropriate balance of criteria required of Board members.

The Nominating and Corporate Governance Committee may apply several criteria in selecting nominees. At a minimum, it considers (a) whether each such nominee has demonstrated, by significant accomplishment in his or her field, an ability to make a meaningful contribution to the Board'sBoard’s oversight of the business and affairs of the Company and (b) the nominee'snominee’s reputation for honesty and ethical conduct in his or her personal and professional activities. Additional factors which that

the Nominating and Corporate Governance Committee may consider include a

candidate'scandidate’s specific experiences and skills, expertise, diversity, personal and professional integrity, character, business judgment, time availability in light of other commitments, dedication, conflicts of interest and such other relevant factors as it considers appropriate in the context of the needs of the Board. Although the Company has no diversity policy, the Board believes that diversity is an important consideration in Board composition, with diversity being broadly construed to mean a variety of opinions, perspectives, experiences and backgrounds, including gender, race and ethnicity differences, as well as other differentiating characteristics, all in the context of the requirements of the Board at that point in time.

The Nominating and Corporate Governance Committee considers candidates recommended by stockholders pursuant to the Nominating and Corporate Governance Committee'sCommittee’s policy for considering stockholder recommendations of director nominees. The Nominating and Corporate Governance Committee'sCommittee’s policy is available free of charge on the Company'sCompany’s website atat: http://investor.2u.com/investor.2u.com. Pursuant to the policy, and at its next appropriate meeting following receipt of a recommendation, the Nominating and Corporate Governance Committee will consider all director candidates recommended by the Company'sCompany’s stockholders provided such recommendation is delivered in a timely manner and in the proper form, as specified in the policy. All director nominees so submitted by the Company'sCompany’s stockholders will be evaluated in the same manner as recommendations received from management or members of the Board. Process for Stockholder Nomination of Directors